Jun 7 2021 1020 AM updated 2y ago. The Employees Provident Fund EPF has revealed full details for the i-Sinar program which will allow eligible members to make withdrawals from Account 1.

I Sinar A Rm56bil Question Mark The Star

The process of verification is required to avoid fraud and improper withdrawal of i-Sinar funds by third parties.

. For those with they can withdraw any amount up to RM10000. EPF full withdrawal I Sinar 20 Bantu rakyat dengan duit rakyat. However the amount withdrawn will be subject to the account balance.

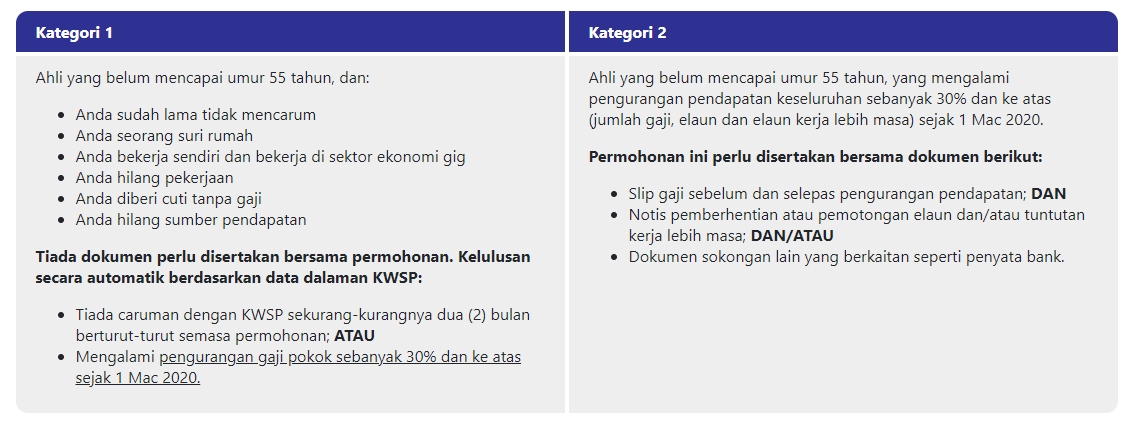

Applications start from 21 Dec 2020. According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. This initiative was launched by the EPF for the purpose of easing the financial burden of members whove been affected by the Covid-19.

The i-Sinar program was introduced to assist members who are affected by the current pandemic situation. Let them withdraw all lah. The Employees Provident Fund EPF has will open registrations for i-Sinar starting 21 December.

It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021. Affected members who wish to take out funds are able. A Account 1 savings RM100000.

The process of verification is required to avoid fraud and improper withdrawal of i-Sinar funds by third parties. KUALA LUMPUR 2 March 2021. New applications after removal of criteria to begin 8 March 2021.

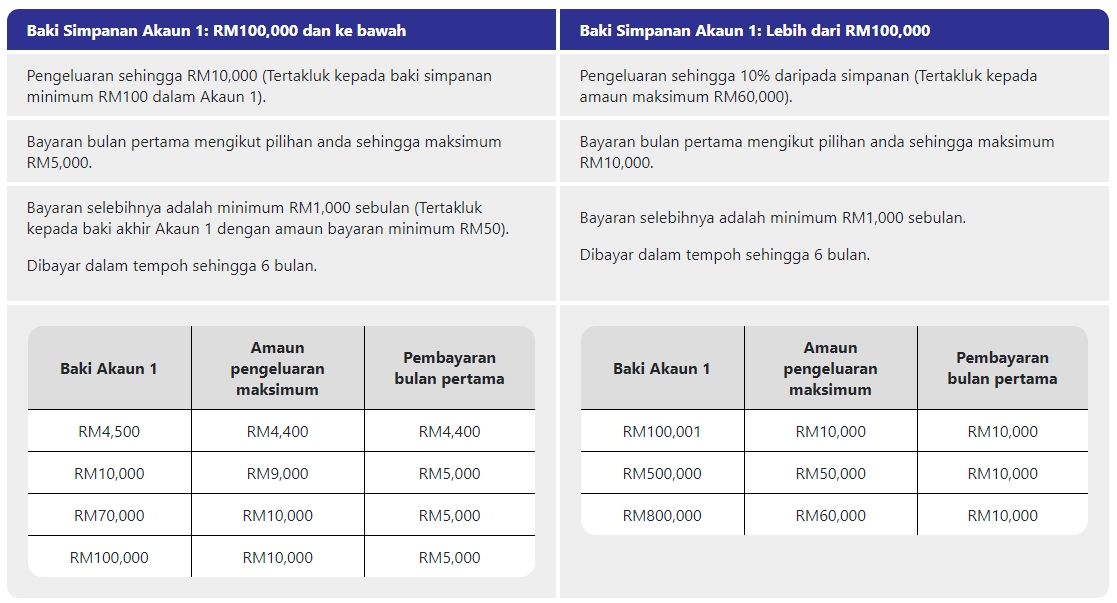

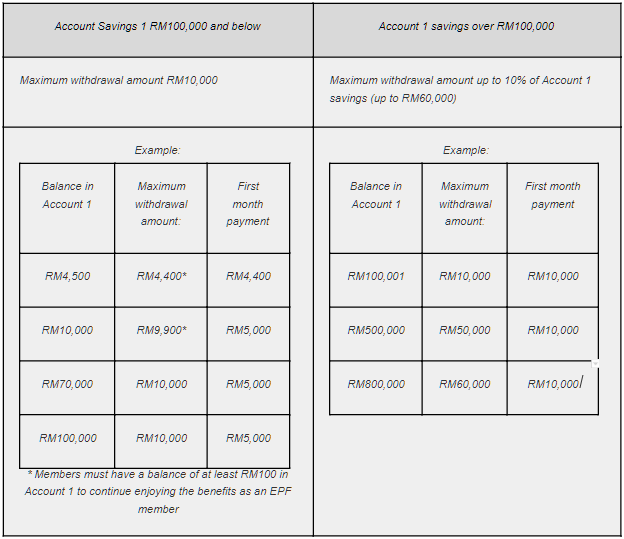

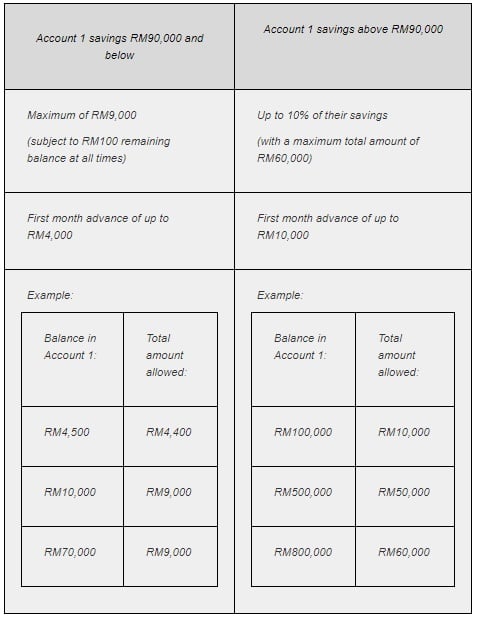

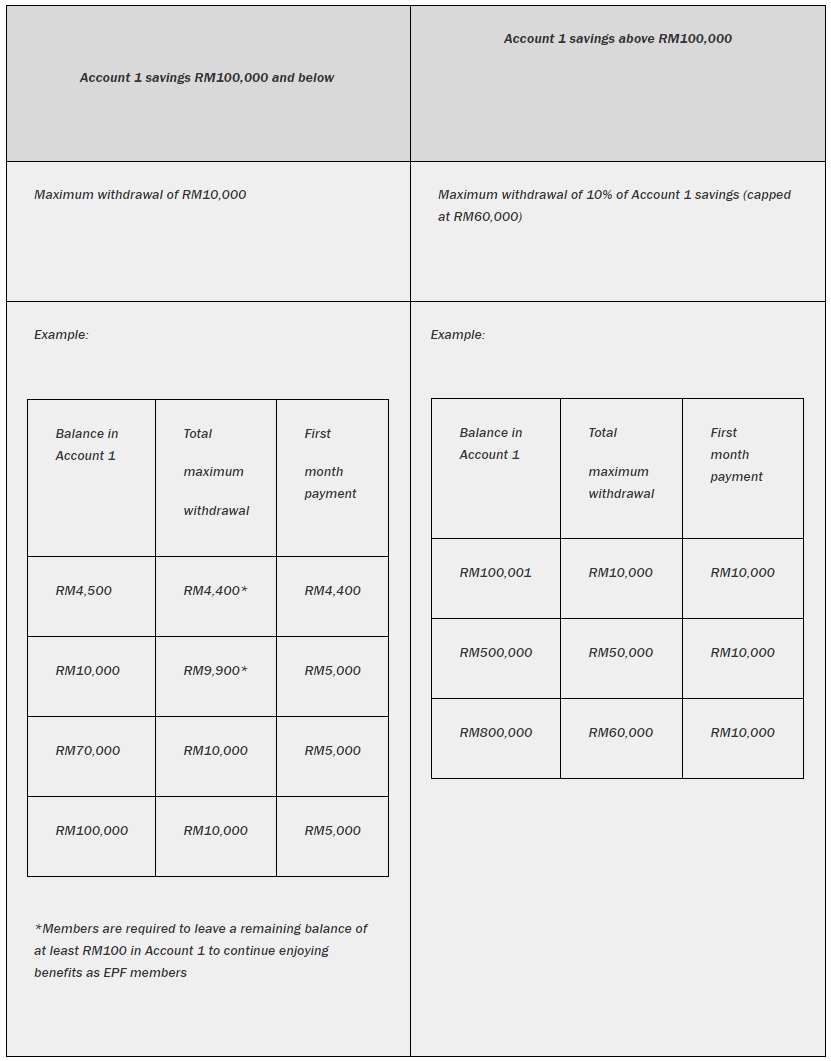

The eligible amount for i-Sinar is subject to the members Account 1 balance based on the latest details below. Show posts by this member only Post 1. The government had previously allowed the withdrawal of EPF contributions through various schemes namely i-Lestari i-Sinar and i-Citra amounting to RM101 billion.

However the amounts for. Malaysians are rejoicing as the government has agreed to approve another withdrawal of Employees Provident Fund EPF savings of RM10000. For those who have.

Payments will be staggered over a maximum period of six 6 months with the first payment of up to RM5000. KUALA LUMPUR April 1. The Employees Provident Fund EPF is in the process of lifting several conditions for the i-Sinar withdrawal facility which among others will allow contributors under the age of 55 to withdraw from their Account 1 funds.

For members who fulfill the criteria their application will be approved automatically the EPF said. Following the removal of the criteria for the i-Sinar facility in February 2021 the Employees Provident Fund EPF announces that applications that were submitted before 25 February will be progressively approved in batches and payments will begin from 2 March. He said for members who had already applied for i-Sinar under the current criteria their applications would be automatically approved in due course.

The EPF i-Sinar initiative enables EPF members to make a partial withdrawal from their savings in EPF Account 1. You can choose how much to withdraw in the first payout but the subsequent payments must be at least RM1000 per month. It said only confirmation of the maximum amount is required during members online application which is not difficult.

This was done via the i-Lestari i-Sinar and i-Citra schemes which resulted in a total withdrawal of RM 101 billion by 74 million members. The removal of conditions will allow EPF members under the age of 55 to withdraw from their Account 1 funds subject to their existing balance Tengku Zafrul said in a statement today. The unconditional withdrawals under the Employees Provident Funds EPF i-Sinar facility is expected to provide an immediate positive impact to the economy in terms of consumption said Bank Negara Malaysia BNM deputy governor Datuk Abdul Rasheed GhaffourRasheed however stressed the need to boost the publics retirement.

The actual amount that you can withdraw under the i-Sinar facility depends on whether you have more or below than RM100000 savings in your Account 1. Junior Member 38 posts Joined. Speak truthfully Gov need to relook what they are doing People with EPF less than 20k saving.

How much can you withdraw from EPF i-Sinar. For members who fulfil the criteria their application will be approved automaticallyOnly confirmation of the maximum amount is required during members online application and is not difficult. 1 According to EPF this has resulted in 61 million members having less than RM 10000 currently in their savings and a staggering 79 of them having less than RM 1000 left consequently.

The State Of The Nation Rm90 Bil I Sinar Withdrawal Changes Odds Of 5 Epf 2021 Dividend The Edge Markets

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

I Sinar Category 2 How To Apply And Eligibility Comparehero

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

Epf Account 1 Withdrawal I Sinar The Pros And Cons

Epf I Sinar Akaun 1 Advance Facility What You Need To Know

Here S How You Can Get Access To Your Epf Account 1 Hr News

I Sinar 8 Other Things You Can Use Your Epf For

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar Applications Are Now Open For Category 1 Here S How To Apply

Epf Announces Terms For I Sinar Withdrawal

I Sinar Category 2 How To Apply And Eligibility Comparehero

Bernama Epf Offers Further Details On I Sinar In Response To Media Query

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Nestia

How To Apply For Epf I Sinar Withdrawal Facility

Why I Sinar Went Wrong And Why Epf Contributors Shouldn T Be Treated Like White Knights Consumers Association Penang

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau